Car Loan Dsr Malaysia

On top of the reasons above banks have become stricter in car loan approvals. Hire Purchase Fixed Rate Interest Rate.

How To Get Your Car Loan Approved Here Are 5 Things That Affect Your Chances Wapcar

Banks will only allow you to borrow up to a certain amount of your DSR across all your commitments.

. Car Loan Approvals Are Tougher During the Pandemic. Total interest over loan period. A bank in instalments over a period of time.

Established in 1990 CTOS is Malaysias leading. With a flat interest rate the amount of interest paid is fixed upon the principal and does not diminish the more you pay. Malaysian Automotive Association MAA president Datuk Aishah Ahmad said applicants are faced with longer approval times because lenders are adding on to the criteria required for approval.

Paying monthly commitment of RM2500 commitments can be car loans personal loans credit cards etc Your DSR before taking a new housing loan will be. As such Janes additional monthly instalment cannot be more than RM300. DSR RM2500 RM5000 05 or 50.

Debt service ratio is a ratio to show how much current borrowing compares to your current income. Simply put the formula is as follows. From this ratio it can help you to recognize either you are in a healthy financial position or unhealthy financial position.

Gaji di bawah RM3000 DSR dikira dengan kadar 50 manakala gaji RM3000 ke RM5000 ialah 60. RM5000 x 5 RM250 Commitments for new housing loan. AmBank Arif Hire Purchase-i.

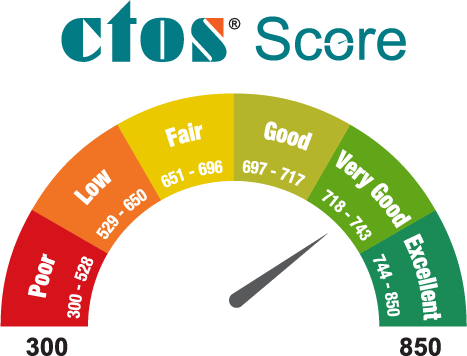

2022 bank islam. One way to check your credit score is through Bank Negara Malaysias CCRIS or CTOS. So try your best to pay your credit card bills car loan and other on time one way to do it is by setting a payment reminder on your smartphone.

DSR qualification is 70. RM2000 Total commitments are RM800RM1000RM250RM2000 RM405000 Debt Service Ratio. Lets say that you are buying a new house with a monthly loan commitment of RM1000 your DSR will be.

Car Loan Interest Rates. RM4050RM6000 x 100 6750 So if the banks guidelines for DSR is less than 70 he is. RM4000 RM7000 X 100 5714.

However the loan she is subsequently approved for cannot take the total commitment higher than 60. Alliance Bank Hire Purchase. Car Loan Eligibility Calculator.

For example say youre purchasing a car with a loan of RM74000 and the interest rate is 34 per annum for 9 years. Personal Loan RM Housing Loan RM Car Loan RM Credit Card Amount RM Calculate base on 5 of your credit limit. Learn More Apply Now.

The debt service ratio DSR is a debt service measurement that financial lenders use as a rule of thumb when determining the proportion of gross income that is already spent on housing-related and other similar payments. RM700 car loan RM200 PTPTN RM200 credit card RM1100. Debt-service ratio DSRDebt-service ratio is a tool used by financial institutions to calculate the portion of your net income that can be used to service current and new loans.

DSR DebtNet Income X 100. Faedah dicaj mengikut skor pemohon iaitu 1 3 445 4 6 450 455 7 10 perlukan mesyuarat dahulu. Your interest per year would then be.

DSR RM2900 RM463525 100 6256. Housing Loan 1st house. Credit Card Outstanding Balance.

Nett Income below RM3500 max. If you are considering to add a new loan this will be the tool to help you either. Currently has 3 loans.

Nett Income RM3500 and above max. As the name implies car loans in Malaysia is a category of loan taken by a borrower for the specific purpose of buying a car. 34 of RM74000 RM2516.

The tool is used to determine if the loan applicant is over-burdened with loan commitments. Car Loan instalment. DSR qualification is 40.

By taking up a car loan the borrower is obligated to repay the loan amount plus interest to the lender ie. Bank Muamalat Hire Purchase-i. DSR RM1100 RM5000 x 100 22.

DSR is quoted in the form of a percentage with different financial institutions having different DSR. With an income of RM7000 monthly and a monthly commitment of RM4000 Joanne has a debt ratio of 5714. The bank will proceed to adjust Janes new loan amount and tenure to match the remaining DSR sum she is allowed.

3 Remember other factors matter. Bagi gaji RM5000 ke RM7000 ialah 70 dan RM7000 ke atas ialah 75. This includes whether the.

Hong Leong Auto Loan. DSR RM2500 RM1000 RM5000 07 or 70. Total monthly commitments.

Personal Loan RM1000 Housing Loan RM2500 and Car Loan RM500 Total monthly commitment. Debt Service Ratio DSR Calculator. Total Commitment RM Dept Service Ratio DSR.

Public Bank Aitab Hire Purchase-i. Her debt service ratio would be calculated as. Pidm dis brochure list of insured deposit privacy policy list of insured deposit privacy policy.

DSR DSR Total Commitment Nett Income 100 CASE 1. Most banks in Malaysia accept a maximum DSR of about 65-70 therefore it is essential that you learn to calculate your DSR before you apply for a property loan. The result is then multiplied by 100 to obtain the Debt Service Ratio DSR percentage.

Issues such as late payments can give a bad impression to lenders and might impact your future application.

How To Get Your Car Loan Approved Here Are 5 Things That Affect Your Chances Wapcar

Car Loan Eligibility Calculator Ctos Malaysia S Leading Credit Reporting Agency

Comments

Post a Comment